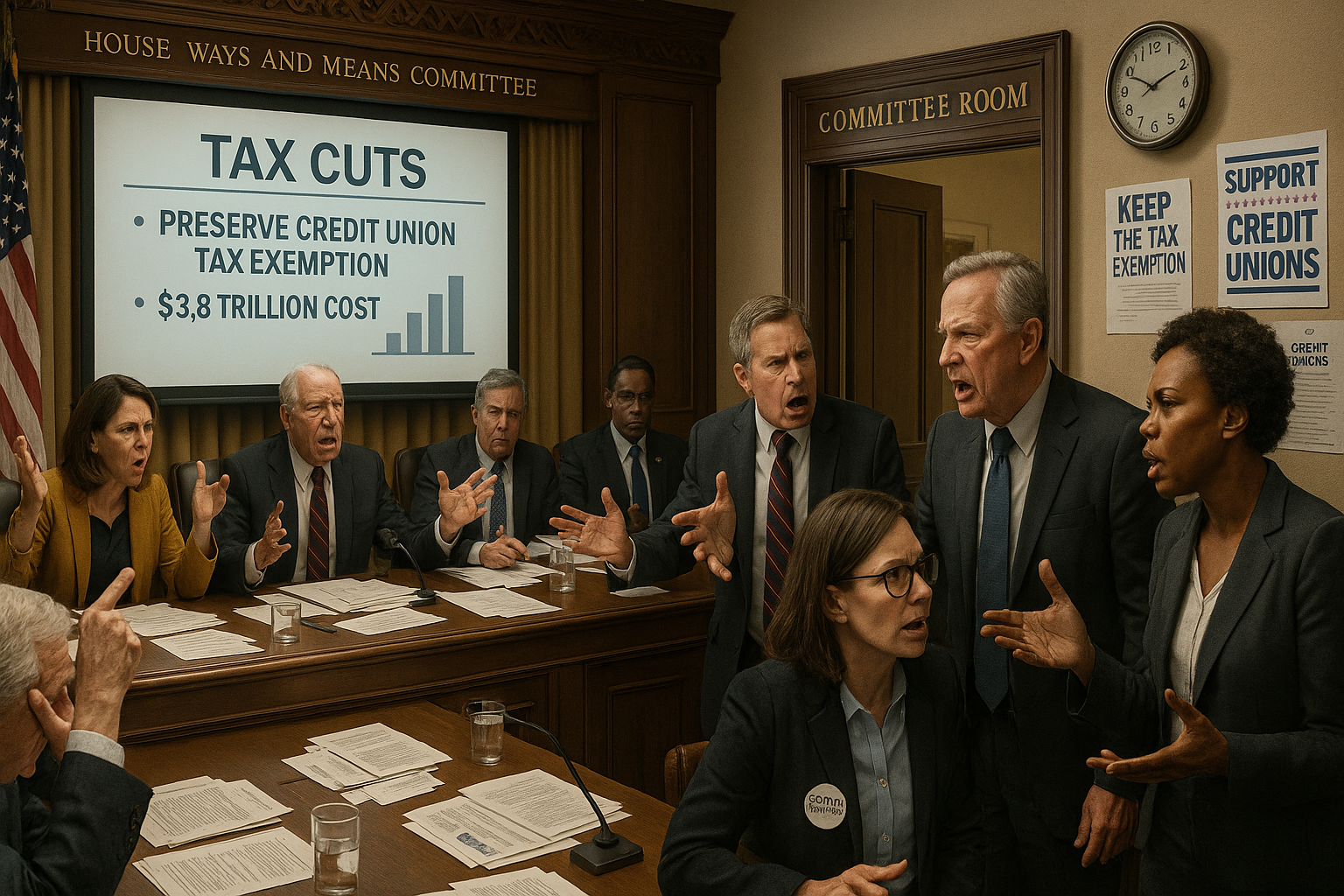

House Ways and Means Committee Advances Crucial Tax Package: Spotlight on Credit Union Exemption Amid Growing Political Scrutiny

House Ways and Means Committee Advances Tax Package, Preserving Credit Union Exemption—for Now

The House Ways and Means Committee on Wednesday advanced a sweeping, nearly 400-page tax package along party lines after an intense overnight session, keeping the federal tax exemption for credit unions intact—at least in the current draft. The bill, which bundles a range of tax and economic priorities from the Trump administration, now proceeds to the House Rules Committee for potential floor debate and a final House vote, possibly as soon as this week.

The committee’s markup session was contentious, with Republicans defeating all Democratic amendments. Democrats sought changes like strengthened health care access and green energy incentives, but the majority stayed focused on rallying around the package’s core provisions, which largely seek to extend and cement the 2017 Trump tax cuts. According to the Joint Committee on Taxation, the overall cost of the measure is estimated at $3.8 trillion over the next decade, and it will likely confer the greatest benefits to high-income Americans—a point of continued debate between the parties. The package may also revisit the cap on state and local tax (SALT) deductions, another high-profile bargaining chip as negotiations continue according to Politico’s reporting.

Credit Union Tax Exemption Survives—But Remains at Risk

For credit union leaders, the most closely watched provision was the preservation of the industry’s long-standing federal tax exemption. In recent weeks, some House Republicans had floated the idea of eliminating this exemption as a way to offset the enormous cost of extending the Trump-era tax cuts, raising alarms across the credit union sector. While the provision did not appear in the committee-approved draft, the fact that it was seriously considered—and could be revived during final House-Senate negotiations—makes it critical for industry stakeholders to remain vigilant as reported by American Banker.

The current threat underscores a broader trend: the credit union tax exemption, long regarded as sacrosanct, is increasingly being discussed as a potential source of federal revenue. Some in Congress view the exemption as a possible “pay-for” to finance major legislative packages, especially in highly politicized settings like this year’s comprehensive tax overhaul effort American Banker notes.

Industry Advocacy and Ongoing Lobbying Campaign

America’s Credit Unions, the sector’s main advocacy group, and allied trade organizations have responded with an aggressive lobbying effort. In recent weeks, they’ve organized joint letters to lawmakers and mounted a coordinated campaign to remind Congress of the crucial role credit unions play in serving underserved communities, returning value to members, and offering lower rates—a mission they argue is made possible by the tax exemption according to their own communications.

Jim Nussle, CEO of America’s Credit Unions, has expressed cautious optimism but insists on a continued “stay out” strategy. In a Wednesday call, Nussle cautioned that final negotiations—especially the House-Senate reconciliation process—are often fertile ground for unexpected last-minute amendments. “There is almost invariably a meeting nowadays at the end of a big bill like this, a big reconciliation bill like this, where the leader of the Senate…and the speaker of the House…are going to get together…and they’re going to say, ‘how are we going to get this bill across both our floors?’ That last mile, those last few moments, are going to be pivotal as well, so we’re not going to let up,” Nussle said, urging the industry to keep up its advocacy as the bill moves to the floor per American Banker.

A Divided Policy Environment—and Growing Scrutiny

While credit unions remain officially nonprofit, community-focused institutions, the expansion of some of the largest credit unions into broader markets has attracted criticism, particularly from the banking sector. The Independent Community Bankers of America, for instance, is now calling for the elimination of the federal income tax exemption for only the largest credit unions, arguing that they compete directly with tax-paying banks while enjoying a significant competitive advantage American Banker reports. This growing pressure marks a shift in the political calculus and might explain why the exemption is now periodically floated in high-stakes negotiations, rather than being treated as untouchable.

At the same time, Democrats and consumer advocates have sounded alarms about the larger tax bill, arguing it is largely a windfall for the wealthy and does too little for working families. Republicans counter that enhancements to the Child Tax Credit, increases to the standard deduction, and incentives for tips and overtime show the party’s efforts to broaden benefits according to UPI. Nonetheless, the measure’s estimated $3.8 trillion price tag increases the likelihood that all revenue-raising options—including the credit union exemption—could re-enter the conversation as lawmakers look for offsets according to Politico.

Next Steps and Outlook for Credit Unions

The House tax bill’s next stop is the House Rules Committee, which will set the terms for floor debate and amendments. Speaker Mike Johnson has indicated that House leadership is working to finalize an agreement quickly, aiming for a full chamber vote by Memorial Day. If the bill passes the House, it will move to the Senate, where further changes—including renewed scrutiny of the credit union exemption—remain possible per Politico.

For credit union executives, the message is clear: maintain proactive engagement with lawmakers, reinforce the value proposition of the credit union model, and be prepared for the exemption to become a bargaining chip in the turbulent final stages of tax negotiations. The latest developments are a reminder that while the exemption survived this round, its long-term future is anything but certain amid shifting fiscal and political priorities.