Empowering the Amarillo Community: How Access Community Credit Union’s Free Financial Workshops Enhance Economic Wellness

Access Community Credit Union Expands Financial Education Workshops for Amarillo Community

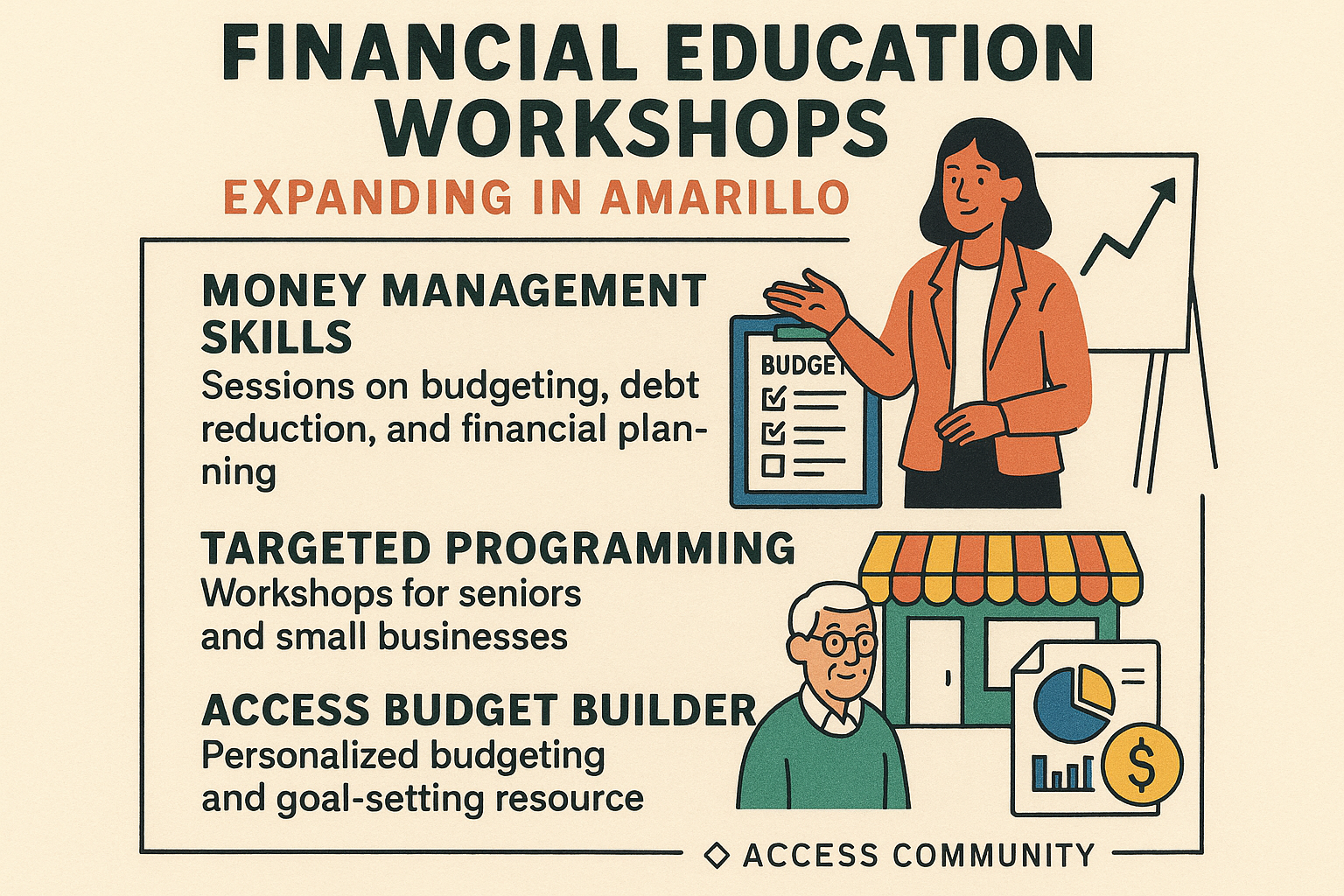

In response to growing economic challenges, Access Community Credit Union (ACCU) has launched an expanded series of free financial education workshops specifically designed to support nonprofits and small businesses in the Amarillo area. These initiatives represent a significant commitment to community financial wellness at a time when many organizations are facing budgetary constraints.

Tracy Shea, business development officer at ACCU, recently highlighted the credit union’s efforts in an interview with Kelsey Davis of KFDA. “Our goal is to help community members develop practical money management skills that can be applied immediately,” explained Shea during the conversation featured on KFDA’s “The Chat” program. The workshops aim to provide participants with concrete strategies to take control of spending and create effective budgets during economically challenging periods.

ACCU offers these educational resources completely free of charge to both members and non-members throughout the Amarillo community, demonstrating their commitment to financial education beyond their immediate membership base. The credit union’s financial education program includes specialized workshops on budgeting, debt reduction, and financial planning tailored to different audiences.

Workshop Focus Areas and Target Audiences

The workshop series covers a diverse range of financial topics with specialized sessions for different demographic groups. One notable upcoming event is their “Financial Wellness for Seniors” workshop, which was promoted on the credit union’s Instagram earlier this year. This particular workshop addresses the unique financial challenges faced by older adults, including retirement planning, protection against financial fraud, and healthcare cost management.

Small businesses and nonprofits receive particular attention in ACCU’s educational programming. These organizations often operate with limited resources and can benefit significantly from improved financial management practices. Workshop topics for these groups include cash flow management, budget development, financial reporting, and strategic planning for fiscal sustainability.

The comprehensive Access Budget Builder program serves as the centerpiece of these educational initiatives. This resource provides participants with practical tools to create customized budgets, track expenses, and develop financial goals. The program emphasizes the connection between credit management and budgeting, helping participants understand how improved financial habits can positively impact their credit profiles.

Impact on Credit Union Industry and Member Relations

For credit union executives across the country, ACCU’s approach offers valuable insights into effective community engagement and member service expansion. By positioning themselves as financial education leaders, credit unions can strengthen community relationships while potentially growing their membership base.

Financial education initiatives like these align with the credit union industry’s broader shift toward more comprehensive member service models. As financial institutions face increasing competition, the ability to provide value-added services beyond traditional banking products has become a critical differentiator.

The timing of ACCU’s expanded workshop offerings is particularly relevant given current economic conditions. With many households and organizations experiencing financial pressure, these educational resources address immediate needs while potentially reducing loan delinquencies and improving member financial health—outcomes that benefit both the community and the credit union’s bottom line.

Implementation Strategies for Other Credit Unions

Credit unions considering similar educational initiatives should note several key aspects of ACCU’s approach. First, their program leverages multiple delivery channels, including in-person workshops and digital resources, to maximize accessibility. Second, by opening these resources to non-members, ACCU creates opportunities for membership growth while fulfilling their community service mission.

The development of specialized content for different audience segments—seniors, small businesses, nonprofits—allows for more targeted and relevant financial education. This approach acknowledges that financial challenges and solutions vary significantly across different demographic and organizational groups.

For credit unions looking to implement similar programs, industry resources are available. America’s Credit Unions offers several professional development opportunities related to financial education and community engagement, including their Financial Management eSchool: Advanced 2025, which provides staff with the expertise needed to develop and deliver effective financial education programs.

Future Expansion and Measurement

As financial education programs like ACCU’s continue to evolve, credit union leaders should consider how to measure their community impact. Metrics might include workshop attendance, subsequent membership growth, improvements in loan performance among participants, and qualitative feedback from community partners.

Looking ahead, credit unions might consider expanding their educational offerings to address emerging financial challenges and opportunities. Topics such as cryptocurrency management, sustainable investing, and digital banking security represent areas where members increasingly seek guidance.

The America’s Credit Unions 2025 conference lineup includes several events where credit union leaders can share best practices related to financial education and community engagement. The Strategic Growth Conference in Austin (August 18-20, 2025) and the Small Credit Union Conference in Kansas City (November 16-18, 2025) are particularly relevant venues for discussing financial education strategies.

As economic conditions continue to challenge communities across the country, initiatives like ACCU’s financial education workshops demonstrate how credit unions can fulfill their foundational mission of people helping people while strengthening their institutional position. For credit union executives, these programs represent an opportunity to align member service, community impact, and strategic growth objectives.